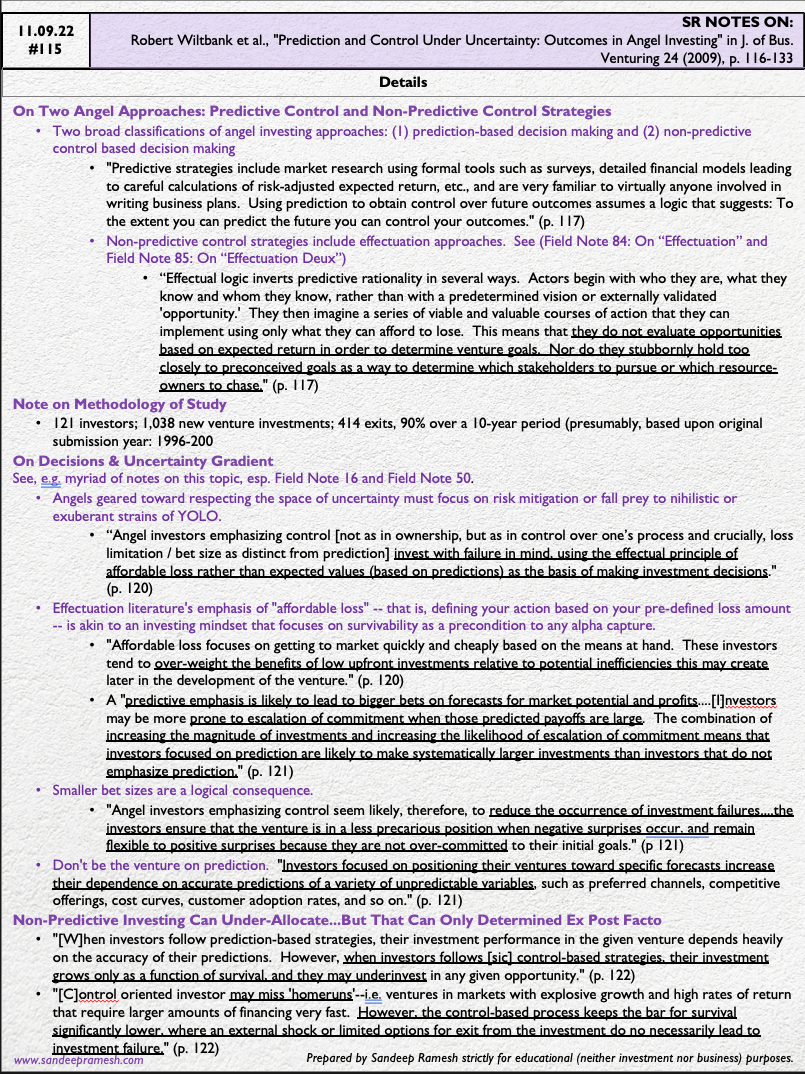

Source: Robert Wiltbank et al., "Prediction and Control Under Uncertainty: Outcomes in Angel Investing" in J. of Bus. Venturing 24 (2009), p. 116-133

Main Implications.

Based on today's source text, a few ideas to workshop are presented below. Disconfirming views and evidence are most welcome, as always.

- Angel investors who have intellectually and experientially learned to deeply respect the gradient of uncertainty (see, e.g., Field Notes #16 and #50) must focus on risk mitigation or fall pretty exuberant YOLO or nihilistic OGWAGD bets.

- Effectuation literature (where the source of this Note is situated) emphasizes "affordable loss" (see Field Notes 84 and 85 on effectuation). In the investing context, this is akin to a philosophy that focuses on survival as a precondition to alpha capture. Sometimes the obvious is paradoxically the hardest to truly grasp.

- Smaller bet sizes are a logical consequence of eschewing the "epistemic arrogance" of prediction in fat-tailed environments (see Field Note #95). This arrogance can be subtle in that one may laugh at the "projections" page in an (early stage) startup deck while taking too seriously prognostications of industry inflections, market forecasts, the durability of the "Midas touch" of other investors in the deal, etc.

- Perhaps controversial: one should seriously question any fund manager running a concentrated book. The "all in" machismo of a "ride or die" strategy in all likelihood is a ride to financial death.

- Perhaps polemical: I suspect--invoking another N.N. Taleb refrain of "skin in the game"--that if those running concentrated books were themselves their own largest LP, the composition of the fund would not, in fact, be as concentrated (unless the % of the person's overall wealth in said fund was relatively small and thus not comporting with the suggested meaning of "skin in the game").

"Results show that angels who emphasize prediction make significantly larger venture investments, while those who emphasize non-predictive control experience a reduction in investment failures without a reduction in their number of successes." (p. 116)

The Details.