Source: Anthony Hodgson, Systems Thinking for a Turbulent World: A Search for New Perspectives (2020)

The Context.

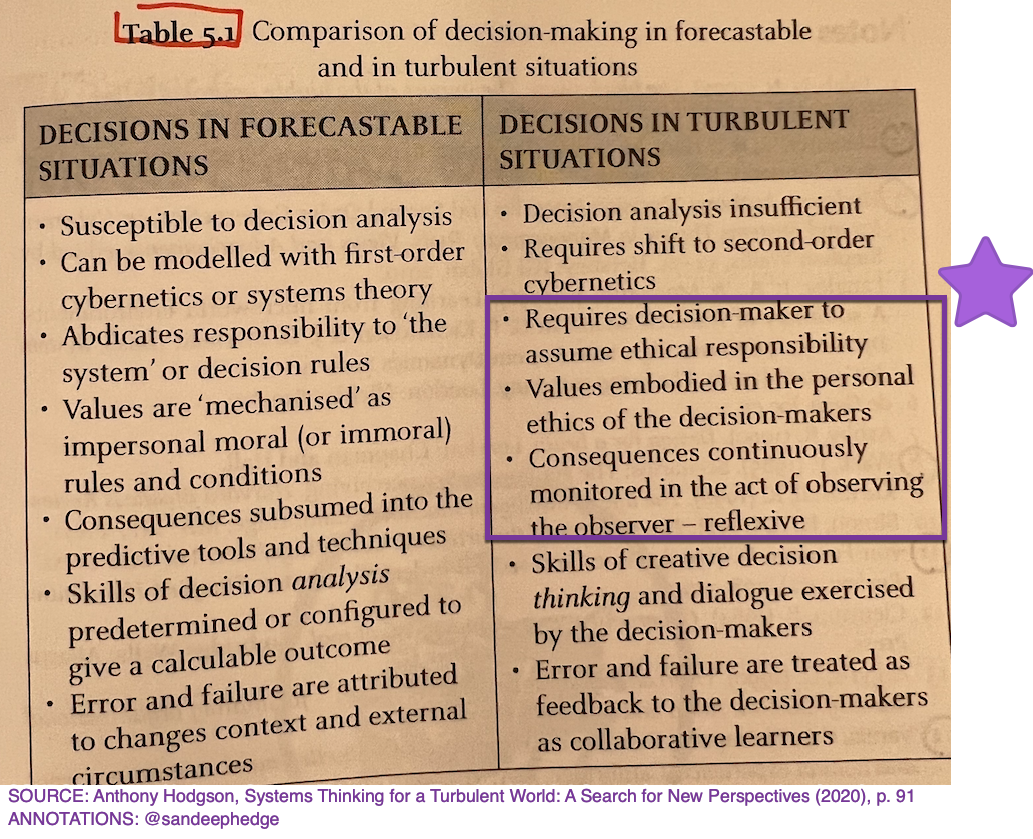

A (hyper)turbulent world requires an equanimous mind as "black swans come thicker and faster, no longer an exception but inclining to be the norm." (Hodgson, p. 79).

In such a world, the stance of a true investor must see the return of ethics as such.

"The implications for how we see the world and our place in it are critical for our understanding of it and our behavior towards it and, more profoundly, as part of it." (Id. at 80, emphasis added).

The impoverishment of the subject is the reason for organized irresponsibility, nefarious activities (in instances, masquerading as "effective altruism"), a normalization of ignorance, overwhelm, and defeatism.

In this context (a "risk society" to invoke Ulrich Beck's term), I find myself too easily gravitating toward cynicism* (see Field Note #92: On "Cynicism Pathology").

After all, the bait is abundant. See, e.g., exploding examples of radioactive information smog from too many VC investor/media specialists & crypto entrepreneur/wagmi bros (*see what I mean; too easily cynical...).

To escape the snare of cynicism, my attention is tuned toward unpacking and reconstituting what it means for me to be an ethical investor embedded in a risk society + how to instantiate that meaning.

And lastly, "the rewards of ethical action lie in the action itself" (Id. at 87).

Who is ready to explore this action? Hmu.

"So there is a close relationship between ethics and choice in the rapid responses and anticipations needed in the face of turbulence. The implication here is that a state of mind or consciousness of the decider is critical for high adaptive performance. If the decider changes state, the decision field changes state therefore, both the practical options and their ethical implications come into the foreground." (Id. at 87)

The Details.