Source: Frank Furedi, Culture of Fear: Risk-Taking & the Morality of Low Expectation (1997)

The Context.

Continuing my contemplations surrounding response & responsibility amidst the multiple layers of contradictions (personally & professionally experienced keenly at all scales) rife in the investing and finance landscape broadly without falling into an apathy or cynicism...

... I recall something that Robert Frey (ex-Renaissance, prof. mathematics @ Stonybrook) once said in a breakout session I had attended:

"Community is the ultimate hedge." A hedge to what? The hyper-individualization of the subject, the stacks of uncertainty, the anxiety around social mistrust, the "cult of expertism," the physical and social isolations that penetrate our exponential tech age, and so on.

This is the mantra espoused by many crypto projects (and the professionalized "community managers") somewhat paradoxically with the technological mantra of "trustlessness" and the primacy of individualized economic incentives that in theory are designed to preserve and advance a collective.

But, what kind of collective? That seems rarely asked. More specifically, what kind of collective ethics?

More than answers right now, I humbly sit with these questions. And so, I am drawn to ponder the following statements written by Furedi in 1997 (see also Field Note #118):

1️⃣ "Thus the distinct feature of society today is not the unprecedented flowering of the individual but the weakening both of a sense of collectivity and of individual aspiration." (p. 142, emphasis added)

2️⃣ "A diminished subject has as its premise a misanthropic view of the world. It is a world inhabited by survivors and damaged people, who know only too well the force of human destruction. Such negative sentiments about people inform the problem of trust, but the breakdown of relations of trust represents a statement about what society thinks of people. Ultimately, the problem of trust is vey much about not being able to trust ourselves." (p. 143, emphasis added)

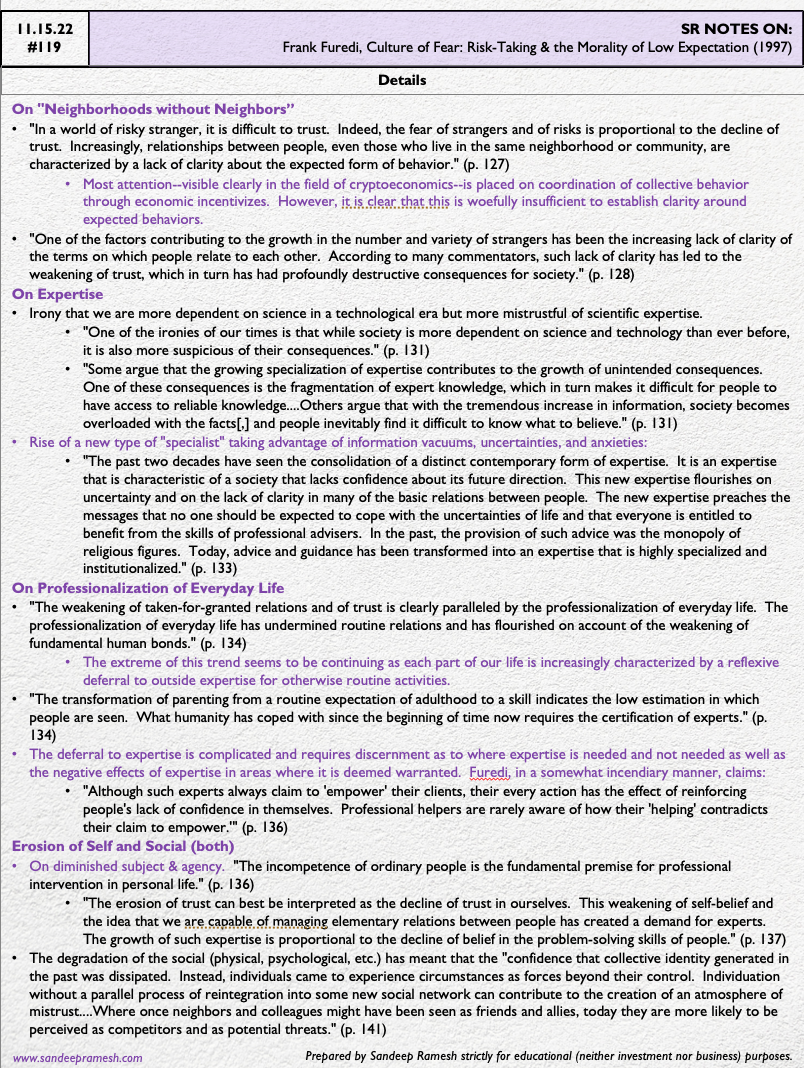

The Details.