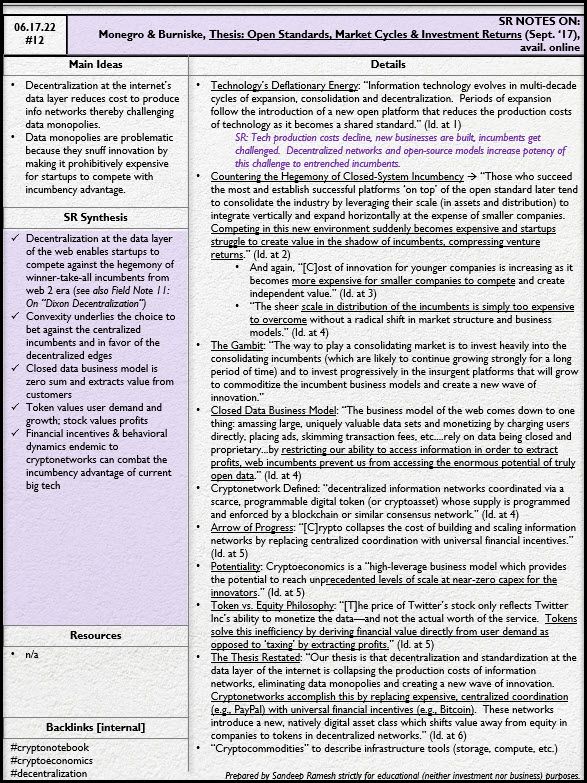

Source: Monegro & Burniske, Thesis: Open Standards, Market Cycles & Investment Returns (Sept. ‘17), avail. online.

- Decentralization at the internet’s data layer reduces cost to produce info networks thereby challenging data monopolies.

- Decentralization at the data layer of the web enables startups to compete against the hegemony of winner-take-all incumbents from web 2 era (see also Field Note 11: On “Dixon Decentralization”)

- Data monopolies are problematic because they snuff innovation by making it prohibitively expensive for startups to compete with incumbency advantage

- Convexity underlies the choice to bet against the centralized incumbents and in favor of the decentralized edges

"Our thesis is that decentralization and standardization at the data layer of the internet is collapsing the production costs of information networks, eliminating data monopolies and creating a new wave of innovation. Cryptonetworks accomplish this by replacing expensive, centralized coordination (e.g., PayPal) with universal financial incentives (e.g., Bitcoin). These networks introduce a new, natively digital asset class which shifts value away from equity in companies to tokens in decentralized networks." (Id. at 6)