Source: Bill Williams, New Trading Dimensions (1998)

The Context.

Perhaps a strange Note, but it was foreshadowed in Field Note #91...

Coming from a world of fundamental investing, having collected (some wonderful) experiences in different asset classes (from distressed securities to equities to credit to credit derivatives to venture) at different shops (from independent to startup to mega scale and mega repute), I observed--in myself and in others--a subtle move over time from fundamental investing to fundamental-ist investing.

As I've explored in Field Note #80. On "Lessons from Adaptive Market Theory" ➡️

"A static statement about financial markets is that they are dynamic. If markets are dynamic, why are most investment approaches static? It is important to note that dynamic != sporadic."

And further, with some mix of polemics and chuckle directed at myself:

"Minimize home bias in financial markets. Embrace diaspora. Perhaps, even run away from home."

Almost 10 years ago, I intellectually left the fundamental(ist) home base to consider strategies and styles that I would have been ridiculed for in my office hallways for even considering.

Ultimately, what all of those (deep) explorations and immersions have taught me is what Bill Williams succinctly wrote in his 1998 book, New Trading Dimensions:

"[T]he primary difference between winners and losers is whether they focus on content or process." (p. 3)

Pithy and an often cited idea, especially in popular decision theory circuits, but not as often taken seriously in practice.

The Main Ideas.

1. Process of Self-Inquiry.

While I explicitly reject Williams's specific buy/sell trading engines detailed in this (and his other) books--and I know from firsthand research that he didn't take them too seriously either--I do embrace his relationship with the market as based on a process of self-inquiry.

This self-inquiry was the catalyst to break down false fundamentalist boundaries.

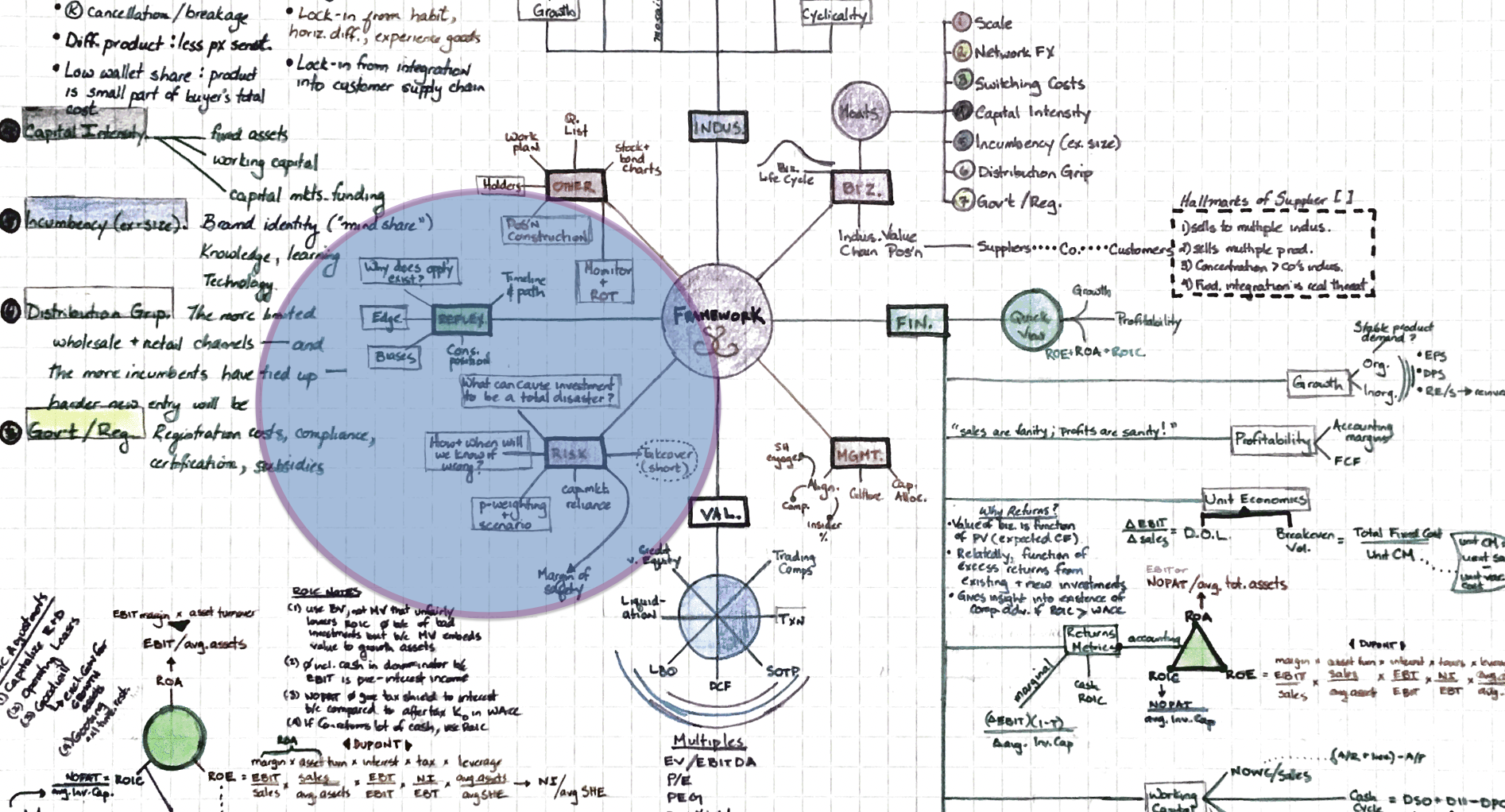

In reviewing my old investment frameworks / maps from years ago, I notice that I had surely been incorporating self-reflexive thinking in making investment decisions (see shaded circle). However, today, the size of that circle is far larger than depicted below:

2. Redefine Your Relationship with Markets.

Often what I hear constantly is the phrase "beat the market." That phrase sounds odd to me. Do I actually want an aggressive, militaristic, pugilistic relationship with the market?

Instead of an adversarial relationship with the market, Williams encourages us to reorient our views of the market. Instead trying to master it, master our relationship to it.

He writes:

"The key to dancing well--and profiting in the market--is an ability to relax and simply go with the flow. That is what this book is about--getting with the process [not the contents of a trading buy/sell system as such], letting go and going with the flow." (p. 3)

I am reminded here of the Taoist view of "wu-wei" (see also Field Note #91. On "Thus Spake Spitznagel, or Amor Fati" on the Nietzschean idea of amor fati).

Because Alan Watts has a particular mastery of paradox and language that I do not, I quote him:

"Literally wu-wei means 'nondoing' or 'nonassertion' as is often mistranslated as 'doing nothing.' But wu-wei means 'nondoing' simply in the sense that by no action of our own can we bring ourselves into harmony with Tao, for, as we have seen, the secret of this harmony in the moment is not action but acceptance of a harmony already achieved by the Tao itself. We do not alter the actual situation; but our attitude toward it undergoes a change whereby we feel harmony where before we felt discord." (Watts, the Meaning of Happiness (1940) p. 171, emphasis added)

3. Implication.

Viewed in such ways, we might see through the negativities amplified in various markets in these times not to condone them, resign to them, or cultivate an acerbic cynicism towards them, but to experience an altogether different process of engagement (amor fati) as we further commit to defining our responses & responsibilities beyond only "edge" and "alpha."

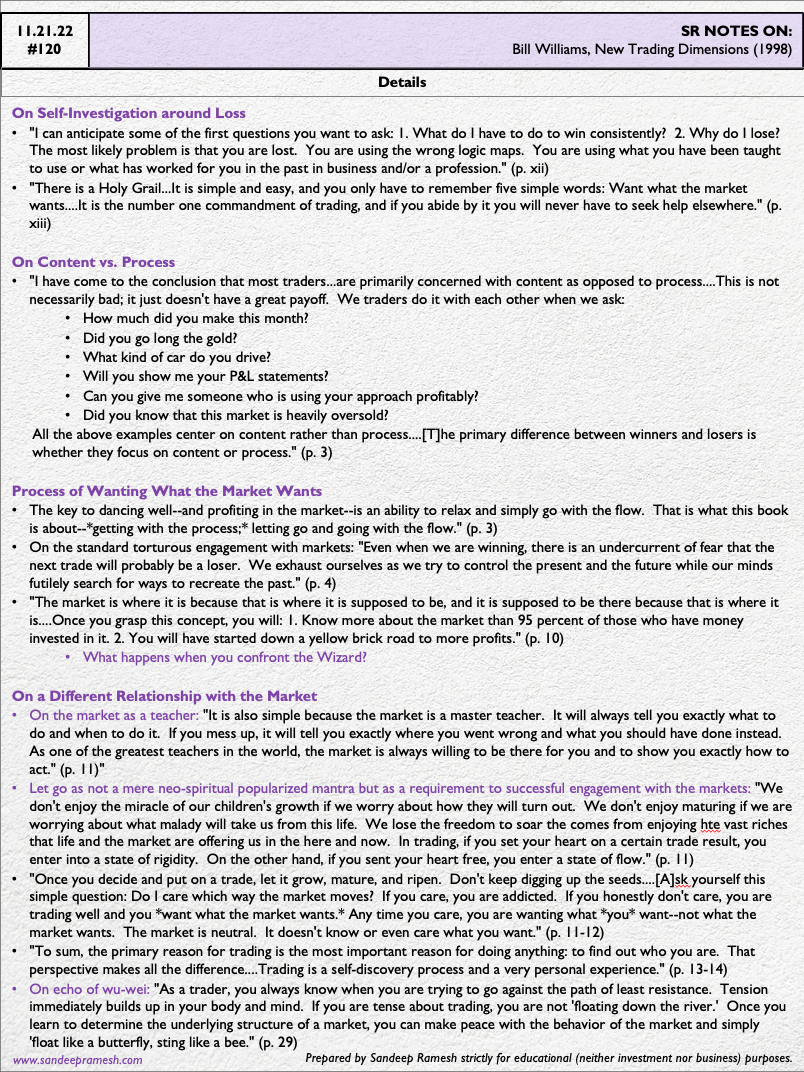

The Details.