Source: Michael Mauboussin, "Who Is on the Other Side?" in BlueMountain Investment Research (2019), avail. online.

The Context.

In my "Tiger cub" days, we were taught to indefatigably ask ourselves and others, "what's the source of our edge in this investment?" Stated differently and more cynically, "why should we be so fortunate to have this investible opportunity?"

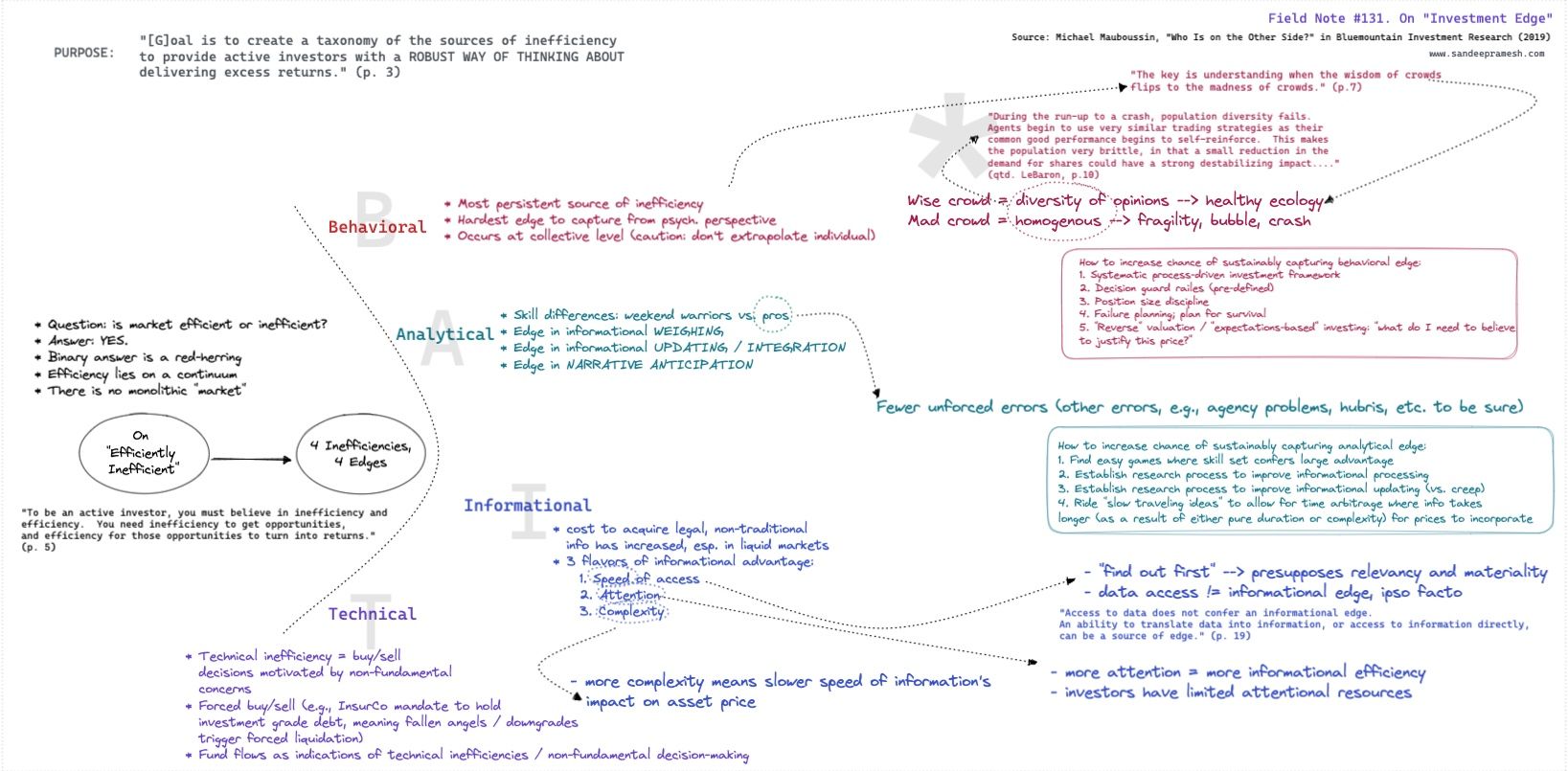

Mauboussin neatly categories the main sources of investment edge, which are derived from the main sources of market inefficiency. With his mnemonic, "B.A.I.T.," we understand those categories to be as follows:

- Behavioral

- Analytical

- Informational

- Technical

I have found this classification to be rough (e.g., in the private market context, one can nest a negotiation advantages under at least 3 of the above categories; and, one may nest exclusivity in deal flow access more or less under the "informational" header).

But, the taxonomic accuracy is not nearly as interesting as the self-reflective question: what's our edge?

And, it is not nearly as important as the corollary question: once identified, how do we sharpen--or at least, maintain--the edge?

Relatedly: how do we know when our edge is gone?

Somewhat ironically, it appears that Mauboussin's piece was commissioned by BlueMountain Capital, another case study tale that reveals to us that despite the B.A.I.T. edges, poor risk management and poor business management can gut you.

(On this last point, consider Field Note #44 dealing with convergent and divergent investment strategies along with Taleb's mantra that it is better to be convex than to be right, which of course assumes an either/or binary...why not strive to be both convex and right, after all?)

The Details.