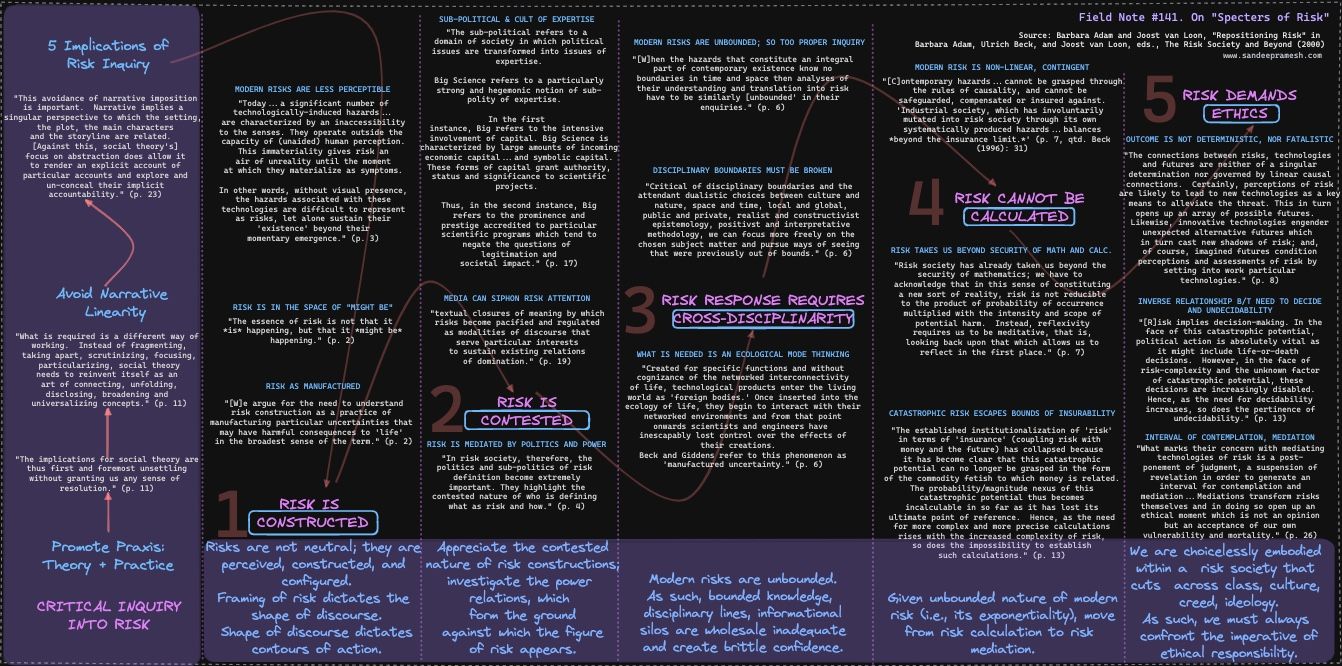

Source: Barbara Adam and Joost van Loon, "Repositioning Risk" in Barbara Adam, Ulrich Beck, and Joost van Loon, eds., The Risk Society and Beyond (2000)

The Context.

The industrialized society has given way to what Ulrich Beck theorized as the modern "risk society." Beck's seminal text Risikogesellschaft was published (in the original German) in 1986, was translated into English in 1992, and continues to be strikingly prophetic in the technological age of "the exponential." (See also, e.g., Field Notes 16, 62, 97, 101, 105).

As is perhaps all too clear from my collection of Field Notes, I am obsessed with risk. But this is not because of my position as an investor or operator. This is also not because of some idiosyncratic fascination.

Rather, it is because we are haunted by risk as such. And, it is from the position of the haunted that Adam and van Loon ask:

"What can social theory contribute to our understanding of the nature of modern risks and to debates about how such risks may be minimized and more justly distributed? What has it to offer with respect to the indeterminate future and the potential dangers posed by techno-hazards that are largely beyond the reach of sense perception?" (p. 1)

In their introductory remarks, the authors demand of us that which we as a whole have been critically unable to do:

"What is required is a different way of working. Instead of fragmenting, taking apart, scrutinizing, focusing, particularizing, social theory needs to reinvent itself as an art of connecting, unfolding, disclosing, broadening and universalizing concepts." (p. 11)

The Summary.

A critical inquiry into risk and an awareness of "risk society" produces 5 threads:

- Risk is constructed

- Risk is contested

- Risk response requires cross-disciplinary ethos

- Risk cannot be classically calculated

- Risk demands ethics (and the outcomes are not deterministic; they are not by default fatalistic)

The Map.

My humble notes are presented here with respect to the above demand.

And, not so humbly, I submit that any investor or entrepreneur incapable or unwilling to probe conceptions of risk (not some glib "risk factor" checklist) is not worth investing in. The economic and/or ethical bankruptcy risk would be exceedingly high (imho).