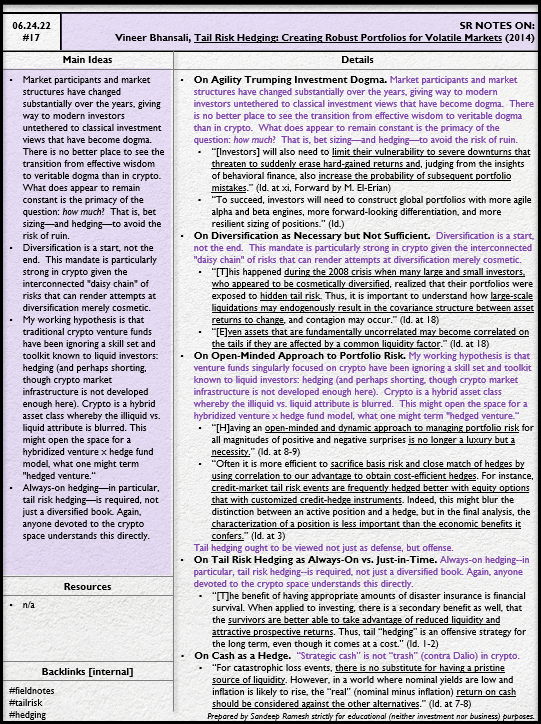

Source: Vineer Bhansali, Tail Risk Hedging: Creating Robust Portfolios for Volatile Markets (2014)

- Market participants and market structures have changed substantially over the years, giving way to modern investors untethered to classical investment views that have become dogma. There is no better place to see the transition from effective wisdom to veritable dogma than in crypto. What does appear to remain constant is the primacy of the question: how much? That is, bet sizing—and hedging—to avoid the risk of ruin.

- Diversification is a start, not the end. This mandate is particularly strong in crypto given the interconnected "daisy chain" of risks that can render attempts at diversification merely cosmetic.

- My working hypothesis is that traditional crypto venture funds have been ignoring a skill set and toolkit known to liquid investors: hedging (and perhaps shorting, though crypto market infrastructure is not developed enough here).

- Crypto is a hybrid asset class whereby the illiquid vs. liquid attribute is blurred. This might open the space for a hybridized venture x hedge fund model, what one might term "hedged venture."

- Always-on hedging—in particular, tail risk hedging—is required, not just a diversified book. Again, anyone devoted to the crypto space understands this directly.