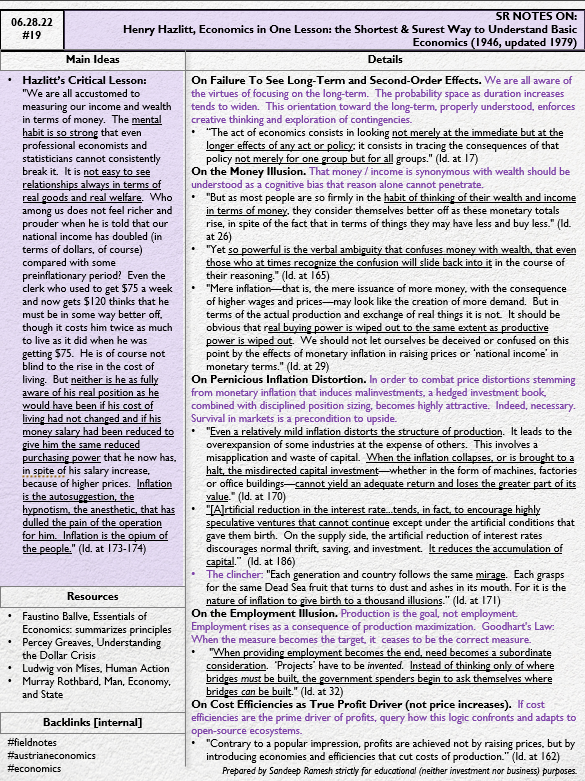

Source: Henry Hazlitt, Economics in One Lesson: the Shortest & Surest Way to Understand Basic Economics (1946, updated 1979)

The beauty of crypto as a research domain is its rhizome structure, demanding multidisciplinary perspectives. Particularly in the (vocal) Bitcoin communities, the reflexive parroting of Austrian economic principles is well observed. As with all hyperbole, there is a root truth. Exploring the possible root led me to Hazlitt's concise text, not from Twitter circa 2022, but from a thoughtful book circa 1946.

(Further exploration of this stem must lead to von Mises, Rothbard, Menger, Bastiat.)

Notes to self (and newly found intellectual jogging + jousting partners):

- We are all aware of the virtues of focusing on the long-term. The probability space as duration increases tends to widen. This orientation toward the long-term, properly understood, enforces creative thinking and exploration of contingencies.

- That money / income is synonymous with wealth should be understood as a cognitive bias that reason alone cannot penetrate.

- In order to combat price distortions stemming from monetary inflation that induces malinvestments, a hedged investment book, combined with disciplined position sizing, becomes highly attractive. Indeed, necessary. Survival in markets is a precondition to upside capture.

- Production is the goal, not employment. Employment rises as a consequence of production maximization. Consider Goodhart's Law: When the measure becomes the target, it ceases to be the correct measure.

- If cost efficiencies are the prime driver of profits, query how this logic confronts and adapts to open-source ecosystems.

Hazlitt's Critical Lesson.

"We are all accustomed to measuring our income and wealth in terms of money. The mental habit is so strong that even professional economists and statisticians cannot consistently break it. It is not easy to see relationships always in terms of real goods and real welfare. Who among us does not feel richer and prouder when he is told that our national income has doubled (in terms of dollars, of course) compared with some preinflationary period? Even the clerk who used to get $75 a week and now gets $120 thinks that he must be in some way better off, though it costs him twice as much to live as it did when he was getting $75. He is of course not blind to the rise in the cost of living. But neither is he as fully aware of his real position as he would have been if his cost of living had not changed and if his money salary had been reduced to give him the same reduced purchasing power that he now has, in spite of his salary increase, because of higher prices. Inflation is the autosuggestion, the hypnotism, the anesthetic, that has dulled the pain of the operation for him. Inflation is the opium of the people." (Id. at 173-174)

"We are all accustomed to measuring our income and wealth in terms of money. The mental habit is so strong that even professional economists and statisticians cannot consistently break it. It is not easy to see relationships always in terms of real goods and real welfare. Who among us does not feel richer and prouder when he is told that our national income has doubled (in terms of dollars, of course) compared with some preinflationary period? Even the clerk who used to get $75 a week and now gets $120 thinks that he must be in some way better off, though it costs him twice as much to live as it did when he was getting $75. He is of course not blind to the rise in the cost of living. But neither is he as fully aware of his real position as he would have been if his cost of living had not changed and if his money salary had been reduced to give him the same reduced purchasing power that he now has, in spite of his salary increase, because of higher prices. Inflation is the autosuggestion, the hypnotism, the anesthetic, that has dulled the pain of the operation for him. Inflation is the opium of the people." (Id. at 173-174)