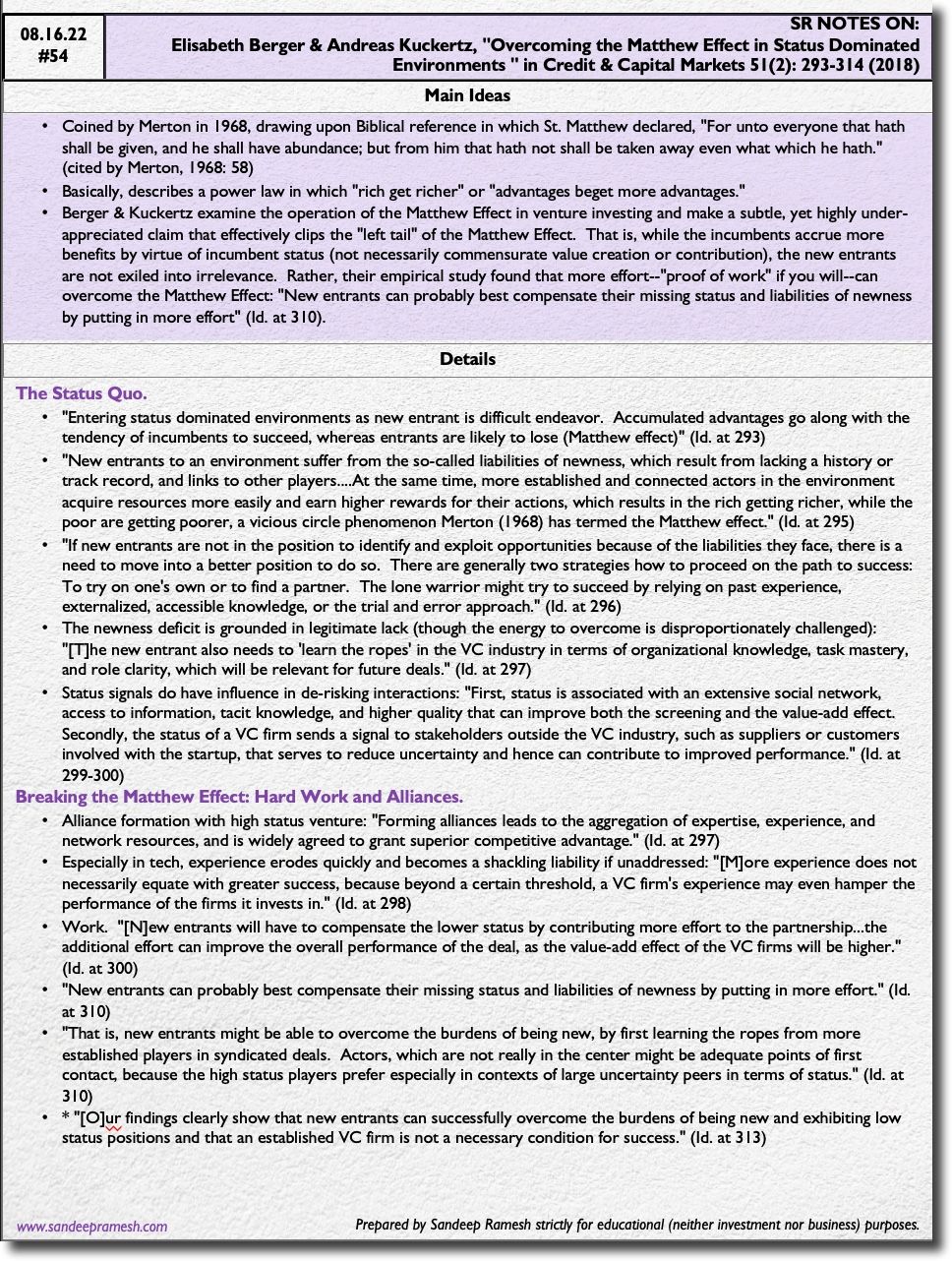

Source: Elisabeth Berger & Andreas Kuckertz, "Overcoming the Matthew Effect in Status Dominated Environments -- a Configurational Analysis of Venture Capital Investments" in Credit & Capital Markets 51(2): 293-314 (2018)

- Issue: Matthew Effect exists in venture (aka "incumbency advantage," "rich get richer," advantage begets advantage")

- Pet Hypothesis: Matthew Effect is far worse in crypto-related domains due to (over)reliance on social (e.g., crypto Twitter), high domain complexity (cult of faux expertise or the Talebian IYI), visibility of status flexes (e.g., invocation of art, iconography), and difficulty in auditing integrity (e.g., anon, high influence of luck in returns/performance).

- Solution: hard work + alliances.

* Hard work works

* Lone wolves starve

The Details.