Source: Alex Greyserman & Kathryn Kaminski, Trend Following with Managed Futures: The Search for Crisis Alpha (ed. 1) (2014)

A static statement about financial markets is that they are dynamic. If markets are dynamic, why are most investment approaches static? It is important to note that dynamic != sporadic.

With this prompt in mind, consider some potential lessons from Greyserman & Kaminski (adapted to my tastes and idiosyncrasies, to be sure), who write about systematic trend following specifically, but more captivatingly about the underlying theory of market structure:

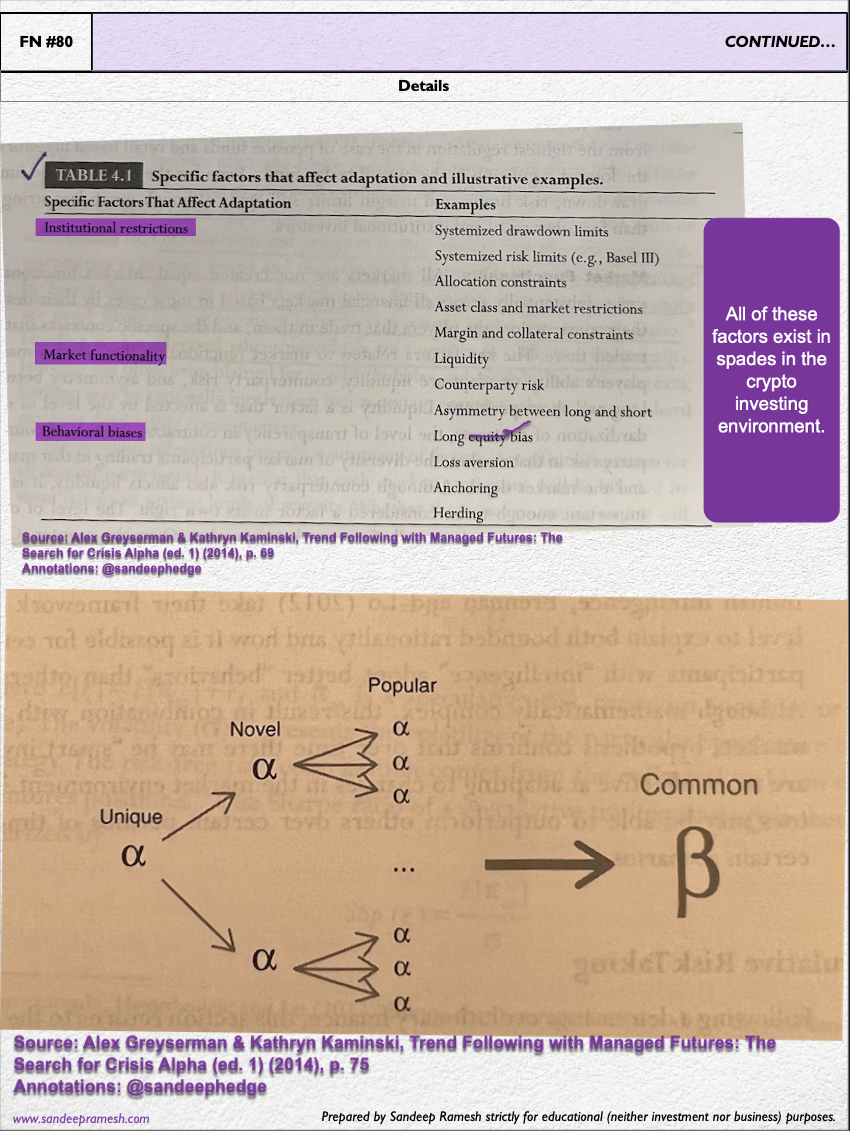

1️⃣ Financial markets are not static. As such, static investment strategies will eventually fail. Adapt or die.

2️⃣ Risk premium is dynamic.

3️⃣ Market efficiency is relative.

4️⃣ Alpha decays.

5️⃣ Heuristics are endemic to human behavior. Embrace them, don't ignore them (see also, eg., Field Note 22 (On "Heuristics, or Simplicity in the Face of Complexity))

6️⃣ Minimize home bias in financial markets. Embrace diaspora. Perhaps, even run away from home.

7️⃣ Build strategies assuming (hyper)turbulence, not pleasant winds.

8️⃣ Capture crisis alpha. To do so, you must not be financially dead.

The Details.